Welcome to the definitive guide to trading penny stocks.

I don’t care if you’ve got 40 years of experience or are just “Thinking” about trading penny stocks… this is the place you need to start.

In this definitive guide, I’m going to walk you through step by step how to trade penny stocks…. What you need to do… might like to do… and shouldn’t do. I’ll give you the lowdown on Penny stock management teams, penny stock brokers, penny stock traders, and penny stock scammers.

I’m going to expose some common myths about penny stocks… and blow the doors off some of the long held beliefs and rules of thumb traders are always talking about.

Finally, I’m going to share with you my more than 2 decades of experience and explain how to sidestep and avoid the scams and scammers out there.

Remember – if you have a question about trading penny stocks or something doesn’t make sense, please shoot us an email at angelina@hotstockanalyst.com. While I can’t reply to every question and comment, I do read them all!

So let’s get started…

Really, What Is A Penny Stock?

This is a question I get asked all the time…

And the funny thing is, there is no official definition.

I read a recent post giving a detailed answer to the question “What is a penny stock?” Follow the link to read all about it. Strange Answers to the question: What Is A Penny Stock?

But, in a nutshell…

Some believe penny stocks trade for under a Dollar… Some penny stocks trade for under $5… and yet other say penny stocks trade for less than $10… What REALLY is a penny stock?

In my world, penny stocks are small companies with stock prices under $10.

Strange right?

Well here’s my thinking…

First, when you buy stock on the exchange, you normally trade a “round lot” or 100 shares.

So, a penny stock trading for say $10 bucks, will cost you a total of $1,000. (100 shares x $10 = $1000). Obviously, the cheaper the stock price, the more shares you can buy. But that gets you a decent position in any stock.

Do you need to spend $1,000 – of course not… I’ll touch on how much money to start trading with later in this report – so, hang in there.

Second, many companies with stock prices under $10 are smaller. And I love small companies. You see, small companies mean bigger growth. Small companies have a long, LONG history of outperforming the rest of the market because of their growth potential… and that’s what I’m after – GROWTH.

Third, many tier one markets like the NYSE and NASDAQ actually discourage the pricing of shares in pennies… that’s right… if a stock price falls too low (often below $1.00), the company can get kicked off the exchange!

As a result, many companies who might have true penny stock prices (Below $1) work to keep the price up through stock splits.

Here’s the takeaway, at the end of the day, you and I shouldn’t care what the price of a penny stock is… only that WE make money from it…

So regardless of whether you think a penny stock is $0.10, $1, $5, or $10… just keep trading!

So that brings us to the next question…

Who Should Trade Penny Stocks?

Now this is a great question… and I’m half of the mind to just say EVERYONE…

But the reality of the situation is, penny stocks are not for everyone.

Do a little self analysis and think about why you’re trading penny stocks…

The Biggest reason WHY PEOPLE TRADE Penny stocks is the Huge gains you can make from them. As a penny stock grows and grows and grows, the gains are compounded in a huge way.

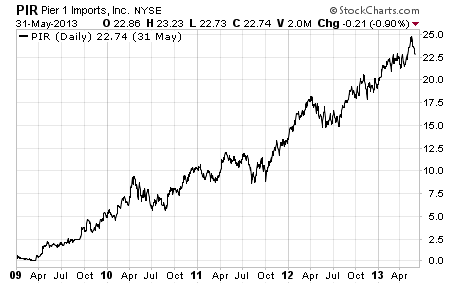

Just look at this classic penny stock… Pier 1 Imports

PIR – generated huge gains – 22,990% for shareholders over just a couple of years.

Here’s how the numbers work out…

On March 13, 2009 PIR closed the day at $0.11 a share… that’s right eleven cents. A few years later, by May of 2013 you could sell those same shares for well over $24 a share. The peak value was a whopping $25.29 on May 15, 2013.

That’s a 22,990% gain!

Think about it, a $1,000 investment would have got you 9,090 shares. Those shares could have been sold for $229,886.10…

Now nobody really buys at the absolute bottom and sells at the very top… but really, would you have been upset with even half of those gains?

That’s why traders LOVE Penny stocks.

But there are people who should not trade penny stocks… ever!

Let me say that again, there are people who should not be trading penny stocks at all…

For example, penny stocks are risky. So you can’t be trading with money you need for your mortgage or rent… or food… or for your kids education.

Penny stocks require research… and that takes time. If you don’t want to commit to putting time into reading and studying about penny stocks… then they probably aren’t for you.

Penny stocks require your constant attention… You don’t need to look at them every hour of every day… but, you can’t ignore them for years and years. So if you don’t like spending a little time every few days or weeks reviewing your investments… you might be better off in a lame mutual fund.

If you’ve never traded stocks before, trading can be exciting and new… but you’ve got to learn the ins and outs of the business. Sometimes trading can get confusing.

It’s not hard, and we’ll do our best to help… but if you hate learning new things… penny stocks might not be for you.

With that said, penny stocks offer an exciting way to profit from the market – if you do it right.

So you’ve decided you want to try your hand at trading and investing in penny stocks… alright let’s keep going…

Why Trading And Investing In Penny Stocks Is A Great Way To Make Money

Earlier, I gave you a great example of the big profits that can be made trading penny stocks… but that’s just one company and one stock.

Let’s take a step back…

Is trading and investing in penny stocks a good way to make money?

The short answer is you bet!

It’s no secret that penny stocks can be one of the most lucrative places to invest your money.

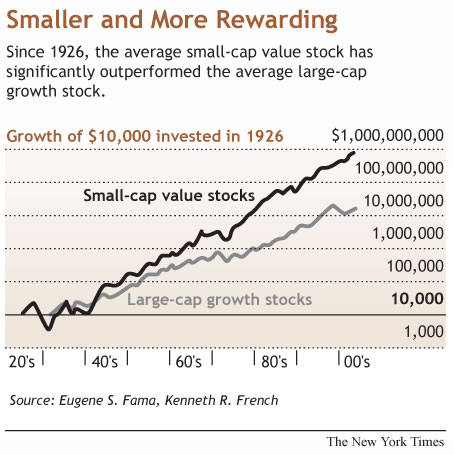

Study after study has shown that small-cap, or penny stocks, have outperformed just about every other asset class including real estate, gold, and blue-chip stocks over the last 85 years. Take a look at this chart from The New York Times…

This chart shows a simple comparison between small cap stocks (penny stocks) and Large cap stocks since 1929. While simply investing $10,000 in large caps stocks would have turned to over $10 million, small cap penny stocks would have turned into close to $1 billion!

That’s right – Almost $1 BILLION!

Look, if you want to be investing in the hottest part of the markets, there’s no question – the hottest part of the markets is penny stocks!

But you’ve got to do it right!

So let’s look at different ways to play penny stocks in the market…

Are you a Penny Stock Trader or Penny Stock Investor?

This is another question many beginning traders have… what’s the difference between a penny stock trader and a penny stock investor?

There are two things that separate a trader from an investor…

Time and Focus.

So what do I mean by time?

Simply a penny stock trader is focused on making a quick score. He’s not looking to hold penny stocks for 5 years, 7 years, or a decade… he’s interested in the quick strikes.

Whereas a Penny Stock Investor is not looking to flip into and out of penny stocks (that said, grabbing a quick gain is never discouraged) but they have the patience to hold onto great story penny stocks for years and years!

As a result, Traders and Investors focus on different things.

For example, Traders look at charts a lot and tend to lean heavily on market indicators. They also focus a bit less on the fundamentals of the investment story. They also don’t shy away from taking quick profits.

The Penny Stock investor on the other hand focuses less on the markets and charts, and really studies the company and their fundamentals… they’ll dig into the financial numbers and analyze markets.

Which style of investing is right?

Both are.

There are very successful penny stock day traders… and very successful penny stock investors.

You need to pick the investment style that best fits your personality…

And, remember, there’s no rule that says you can’t use some combination of the two styles to make money!

The goal is to make money with penny stocks – how you do it is ultimately up to you!

And that brings us to the first rule of penny stock investing…

Rule #1 – Nobody Cares For Your Money More Than You!

Let me say that again… rule number one of penny stock investing is “Nobody cares for your money more than you!”

So, no matter what happens, the responsibility is on your shoulders.

If you trade penny stocks (or any stocks for that matter) bad things can and do happen. People lose money. People lose A LOT of money. It happens.

But you can’t blame:

- The management teams

- Your broker

- The markets

- The Fed

- Some stock promoter

- Your cousin with the hot tip

- Or the writers in your favorite financial publication

Seriously, it’s your money, and if it disappears… if you lose it all… nobody is going to support you in retirement. We’re going to talk about brokers in a bit… but think of it this way… if your broker gives you a hot tip and you lose all your money on it – is he going to let you live at his house and eat his food in retirement?

Of course not.

The same thing goes for the scammers out there.

Trust me, penny stock scammers are everywhere… and they’ve been around forever. Their goal in life is to separate you from your hard earned dollars. One of the things we strive to do is expose these creeps every chance we get…

The problem is they’ve been around forever and they aren’t going anywhere.

So just keep an eye on your money… and if anything is uncomfortable, or you don’t understand an investment… then don’t make it. Put your money back in your pocket.

There’s always another investment around the corner.

So one more time – “Nobody cares for your money more than you!”

And this brings us to penny stock rule #2…

Rule #2 – Focus On ONE Penny Stock Strategy

This is the biggest mistake I see penny stock traders and investors make… they pick a strategy one week, then the next week change it up… then a few months later they’re changing it up again.

It’s like a toddler on a sugar high…

There are hundreds and thousands of ways to make money in the markets… and that goes double for penny stocks!

Don’t believe me?

Just pick up a great trading book called “Market Wizards” or “the New Market Wizards” You can find it at amazon.com – or probably in your public library!

Anyway, Jack Schwager interviews a number of the most successful traders in the world. Besides being a great read… you’ll quickly discover one thing.

EVERY SUCCESSFUL TRADER HAS a unique style and methodology.

There are hundreds of ways to make money… you just need to pick one and stick with it. That’s how you gain experience and knowledge… and that’s how you become a better trader.

It’s true in most things in life…

If you’re even a little bit of a basketball fan you’ll remember Michael Jordan – the greatest player in the NBA. What many fans don’t realize he tried to become a pro baseball player. That’s right… baseball.

Michael Jordan was amazing on the court as a basketball player…

But as a baseball player… It didn’t work… Michael Jordan sucked at professional baseball.

He was an expert in one thing, but not the other…

Trading penny stock is no different. Having a strategy to trading penny stocks online is critical… and you’ve got to pick one and know it inside out.

You can make money as a growth investor, or value investor, or dividend chaser, or turnaround specialist, or technical analyst. The ways to make money are limitless (I think I’ve said that before!)… but you’ve got to know your investing strategy cold.

Let me say that again… know your penny stock strategy cold.

Be a pro at one thing… and let the amateurs jump from strategy to strategy.

There’s nothing that says you can’t change up or modify your strategy in some way… LATER.

Ok, back to the grind…

Once you’ve figured out your Penny stock trading strategy you next need to determine when you should trade penny stocks.

What’s The Best Time To Trade Penny Stocks?

It seems like a strange question… “What’s the best time to trade penny stocks?”

Shouldn’t the answer be any-time?

Well, no, not really.

If you spend any time trading the markets you’ll quickly understand some times are better to make money than others.

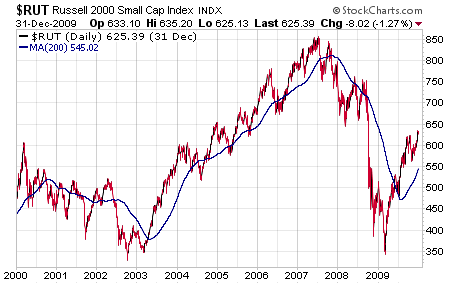

For example take a look at this chart on the Russell 2000 Index… I’ll tell you more about the Russell in a bit… but what you need to know is it’s an easy way to track the small cap / penny stock market.

So, for now just look at the chart.

The chart covers a 10 year period from 2000 to 2010.

The line in blue is a simple 200 day moving average to smooth out the daily gyrations of the market. As you can clearly see there are times when the market was doing well… and other times when it was in a down-trend.

When do you think it was easiest to make money?

You guessed it… it was easier to make money when the market was trending higher. And that’s why the famous Wall Street sayings came into being:

“The TREND is your friend!”

And

“Don’t fight the tape!”

And

“A rising tide lifts all boats!” (That last quote probably came from a fisherman who was trading penny stocks!)

This chart pattern is exactly what traders talk about. As the market moves higher so will most of the other stocks in the market. And when the market moves lower… so do most of the stocks.

Now here’s an important note…

Just because the market is moving higher doesn’t mean every stock will move higher. It also means just because the market is falling not every stock will fall.

There are ways to make money in both up markets and down markets…

But the key takeaway is to pay attention to the markets… It’s easier to make money when the market is heading higher.

Now this brings up a great question…

Why Follow the Russell 2000 Index?

So in my example above, we looked at the Russell 2000 index for our market comparison…

It brings up a number of questions:

- What is the Russell 2000?

- Why Follow the Russell 2000?

- Why not look at the S&P 500 or Dow Jones Industrial Average instead?

All good questions and we can pick them off one at a time…

The Russell 2000 is an index. You can learn all about it here (https://www.ftserussell.com/products/indices/russell-us) or just keep reading and I’ll tell you the important bits.

Anyway, the Russell 2000 is an index or a group of companies. It’s made up of the smallest 2000 companies tracked by the Russell 3000 index.

Is it a perfect index? Nope, not even close.

You see it includes a lot of companies that we’d consider too big to invest in. They’re not all penny stocks… or even small cap stocks.

So why keep looking at this index?

It’s like voting for a president – you pick the lesser of the two evils… here we pick the Russell 2000 because it’s the closest thing we have to a penny stock index. And it has a long track record we can use to our advantage when looking at trends. So it’s better than nothing.

And Russell Investments – who manages the index does do some things right…

They are open and transparent with who’s in the index, how companies get pushed in and out of the index, and when they do rebalancing (The last trading day of May!).

So that brings us to the next question, why follow the Russell 2000?

We need some way to compare what the penny stock market is doing compared to the rest of the stocks out there… and our own investments.

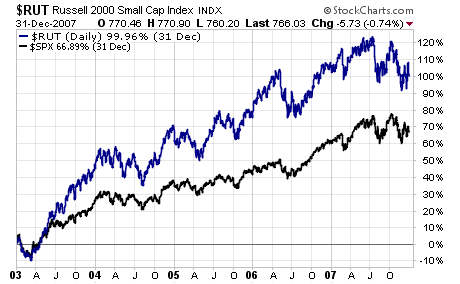

Just take a look at his chart from 2003 to 2008.

In it you can see the performance between the Russell 2000 – (the blue line and our gage of penny stocks) and the S&P 500 (the black line)– an index of the largest 500 companies traded on the US exchanges.

As you can see, performance was radically different.

As you can see form the chart, at numerous times over this 5 year period penny stocks outperformed the larger stocks by almost DOUBLE!

The Russell 2000 is a great way to measure your performance and have a target to measure yourself against.

And that’s why we like to use the Russell 2000 over the S&P 500 or the Dow Jones Industrial average… it gives you a true look at small stock performance.

To pull up a chart of The Russell 2000 you can use the ticker symbol RUT on most systems.

So now we come to another jump in our penny stock education…

Where Do Penny Stocks Trade?

Maybe you know this… maybe you don’t… but stocks are traded on exchanges or markets.

The biggest and most well known market is the New York Stock Exchange – The NYSE.

There are hundreds of exchanges all over the world, and many of them trade penny stocks.

Think of an exchange like an auction house… people bring items to sell (in this case stock or shares in a company) and buyers show up ready to bid (buy those shares).

The balance of buyers and sellers is what the markets look to achieve.

Of course the markets make money by taking a small slice of every transaction… but I’m not going to go too deep into the weeds on this.

Just understand that the Markets are where buyers and sellers meet up to buy and sell stock.

Now over the last few decades the number of exchanges has been dwindling as they merge and computers change the way trading stock is handled…

Now, let’s take a deeper look at these exchanges:

New York Stock Exchange – NYSE

The NYSE is the granddaddy of the exchanges, and globally one of the most powerful. The trading occurs on the floor of the exchange in New York. However for penny stock traders and investors, it has very little impact.

I did a quick search and as I write this, there are only 16 stocks on the NYSE trading for under $1.00… and only 164 trading for under $5 bucks… why so few?

Because the NYSE has a minimum listing price of $2… it means companies wanting to trade on the NYSE must have a stock price over $2. And most trade for much, much more money!

So we might find some good stocks here but let’s look at other exchanges…

NASDAQ Stock Market – NASDAQ

If the NYSE is the granddaddy of the stock markets – the NASDAQ is the fast moving 20 year old hipster of the exchanges. The NASDAQ really made a mark for itself over the last few decades, focusing on trading high tech companies, and using computer technology to create the markets. The NASDAQ invented electronic trading in 1971!

The NASDAQ doesn’t have a central location where stocks are traded… stocks are traded electronically on their network.

Now again I did a quick search and the NASDAQ has 96 companies trading for less than $1… and 589 for under $5.

Remember their minimum listing requirements are $4 for the exchange… so again not a friendly place for penny stocks.

There are other places to trade…

NYSE MKT (formerly American Stock Exchange – AMEX)

For those of you who have been around a while, you might remember the AMEX which was in direct completion with the NYSE… well they were acquired by the parent company of the NYSE in 2008. The new name for the exchange is NYSE MKT. Which is different from the NYSE… Confusing I know.

Anyway, this market still trades stocks and mainly smaller companies… and they have 82 companies that trade under $1.00… and 191 that trade for under $5.

So where are all the penny stocks?

Take a look at these next markets to find out!

OTC Bulletin Board – OTC BB

Now the OTCBB sounds much more promising for finding penny stocks… The OTCBB exchange is operated by FINRA – a NON-government agency that helps regulate the securities industry. Remember the name FINRA – it’s going to come up again!)

They oversee broker dealers and exchanges…

So they have their own exchange listing stocks (actually it’s not an exchange… it’s a quotation system… splitting hairs I know) … it’s just like the NYSE and NASDAQ… but here’s the difference.

ANY company can be quoted on the OTCBB as long as they are fully reporting with the SEC.

In other words they just have to get their paperwork into the SEC, and they’re good to go. They have no minimum capitalization, minimum share price, or other requirements.

Now finding information on these companies can be difficult… and screeners are hard to come by… but one that I found shows 917 companies listed by the OTCBB… and 490 traded under $1… and 599 trading under $5.

So where is everyone else?

OTC Markets Group – Pink Sheets

To dig even deeper we’ve got to visit one of the lesser-known exchanges… the OTC Markets group. OTC Markets Group is a direct competitor of FINRA’s OTCBB. Now keep in mind OTC Markets Group is a public company… and they specialize in the exchange for Over the Counter and abandoned stocks.

Remember how anyone can trade on the OTCBB – as long as they get their SEC filings done…

Well, the OTC Markets group doesn’t even need those SEC filings to be up to date.

What they’ve done is set up a system that ranks companies based on the information they make available. Many companies who don’t file with the SEC do provide the OTC Markets Group with information – including financials… making them one of the largest sources of information on penny stocks on line!

According to the OTC Markets site more than 9,000 stocks trade on these exchanges!

So back to the ranking system:

- OTCQX – these companies must be up to date on their financial disclosures (either with the SEC or through the exchange itself). Minimum price is $0.10.

- OTCQB – This market is less stringent targeting “Venture stage” companies. The company only needs to update their profile at the OTC Market website, have some minimum amounts of financial information be available, and have a minimum price of $0.01. Many international companies are listed here.

- OTCPINK – this is even less stringent for listings… and a lot of people fall out here… many of these companies are in default or distress… or undergoing reorganization.

- OTC Gray – this is like the catch all for stocks that trade “because of a lack of investor interest, company information availability or regulatory compliance”

- Caveat Emptor – this final section is for stocks that are very risky and may be manipulated – this is straight form the company website “Buyer Beware. There is a public interest concern associated with the company, security, or control person which may include but is not limited to a spam campaign, questionable stock promotion, investigation of fraudulent or other criminal activity, regulatory suspensions, or disruptive corporate actions.” In Other Words Stay AWAY!

So now you know more than 99% of the investors trading penny stocks to about how and why they trade…

But what do you care about the differences in penny stocks and what exchange they trade on?

It all comes down to listing requirements.

You see, just because a Penny Stock is on the OTCPINK… or the NYSE doesn’t make it better or worse… it just means that one company meets different financial and disclosure standards… You can make a million bucks with an OTCPINK penny stock just as you can lose every penny you invest in a NYSE penny stock!

Keep in mind, to list on the NYSE or NASDAQ a company has to jump through some serious hurdles – and reach some significant financial milestones… those hurdles are missing in these other markets.

Again it doesn’t make the stocks safer or better… just different.

OK, let’s get back to some fun stuff…

How To Make A MILLION DOLLARS Trading Penny Stocks!

Now this is cool…

Trading penny stocks is one of the few ways that I know you can make a million dollars… with limited effort!

So can it be done?

Of course it can… but not like this…

Maybe you read the story about the High school student who made $72 million trading the stock market… it was the hottest news… until he admitted he LIED! You can read the story here (but why waste your time?)

If you’re looking for stories about millionaires being made from penny stocks just google it. The web is filled with Lies, liars, and little bits of truth.

What I know is every day penny stocks jump in value… and some really soar.

I already showed you Pier One Imports… that stock jumped 22,990% in just a few years… if you’d have put in $5,000 you’d be richer by $1,149,430.30 – There’s your million bucks.

But that’s not the only company to skyrocket in value.

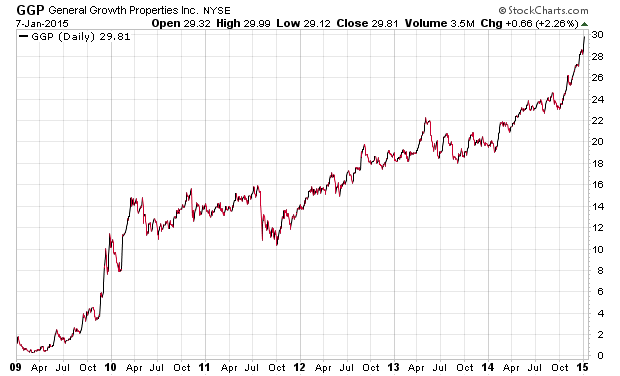

Here’s a company that made Hedge fund investor Bill Ackman famous… GGP – or General Growth properties.

The company was dragged through bankruptcy and came out the other side smelling like a rose.

On March 5th 2009 the stock traded to the lows of $0.33 ($0.23 cents adjusted)… and recently closed at $29.15… a little math shows that to be a return of 12,673%

If you’d have scooped up 34,305 shares of this penny stock at $0.23 cents, it would have set up back $7,890 bucks… and today you’d be a MILLIONAIRE.

There were other beaten down stocks to be found in 2009…

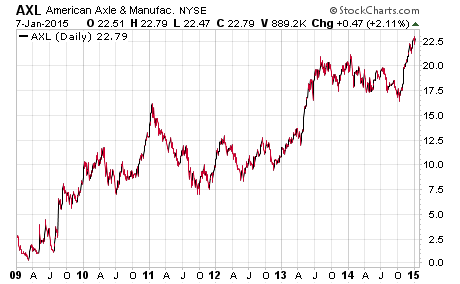

Consider American Axle & Manufacturing (AXL). They make car parts and in March of 2009 they were trading for pennies… 29 pennies to be exact. Today the stock is a pricy $22.79!

Some quick math shows your return over the last few years would have been – 7,858%

If you’d have bought 44,000 shares for a total outlay of $12,760 they’d be worth more than a million today.

See, making millions in penny stocks isn’t a joke or a lie… you just need to find the right company.

Here are a few more…

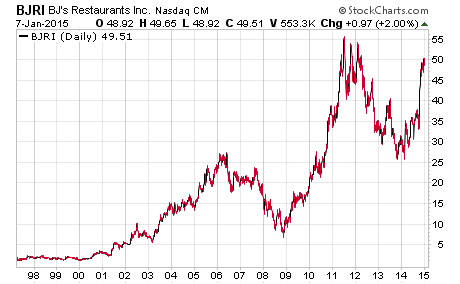

In April of 1997 you could have bought shares in BJ’s Restaurants for just a buck! (Great beer by the way – they have one near us and we go every so often!)

By mid 2011 the stock was trading at its highs over $55 a share. Investing just over $18,000 would have made you a millionaire!

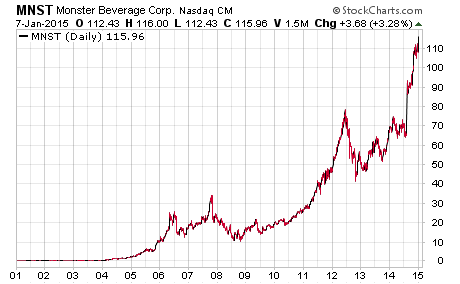

Now here’s a penny stock that was a cool drink for many investors…

Monster Beverage – MNST (formerly Hansen’s Natural) traded hands at just $0.19 a share (split-adjusted) on June 1, 2001. Today that same share trades for $116 bucks!

The gains here just get silly… MNST shows a gain of 61,052% over that time period!

To make a million here… you’d need to own just 8,621 shares… at $0.19 cents that’s a total investment of $1,638.

You could have turned $1,638 into a million!

Damn, I love penny stocks!

There are lots of other examples… but that’s enough for now…

In order to find companies like this you’ve got to get yourself set up and ready to trade… then you’ve got to find the right companies to research, study and ultimately invest in.

So that’s what we’re going to talk about next…

How To Find The Best Penny Stock Brokers

If you want to trade penny stocks, the bottom line is you need a brokerage account.

You’ve got to open an account and fund it (put money in) before you can start making your first trade.

Now, you’ve probably seen tons of advertisements for thousands of different stock brokers… and if you do any research at all, you’ve no doubt see websites listing the top 10 stock brokers… or top 5 stock brokers… or the best stock brokers… or stock broker reviews…

I’ve got to tell you most of it is crap.

Look, I’m not going to tell you one broker is better than the other… all of them follow the same rules for trading stocks… and all of them can buy and sell stocks for you…

But a few comments

There are two types of brokers… do it yourself, and Full service.

With do it yourself accounts, you sign up and they give you an online interface. If you’ve got questions comments or concerns, you’ve got to call a 1-800 number and speak to an account rep.

Most of these do-it-yourself places offer dirt cheap trades, but don’t expect much, if any hand holding.

The full service brokers are getting rarer and rarer.

The full service brokers will assign you an account rep and have someone contact you. They are there to talk to you and educate you and give you ideas. But don’t be fooled… you’ll pay for this extra service. Also, full service brokers tend to have much higher minimum account sizes too!

I prefer the online brokers because I don’t like to foot the bill for a personal broker.

I don’t need ideas, I don’t need hand holding, and I rarely if ever have a question. That’s what works best for me… you need to figure out what’s best for you. So, based on your experience and needs you need to figure out what’s important… and pick the broker that’s best for you.

Now what separates the different online stock brokers?

Now this should go without saying – I stick with the major online brokers. I wouldn’t work with small regional broker dealers… and there are a number of major online brokers.

What sets them apart is their online interface. In other words, the big difference is how their software looks and works for doing research and making trades.

So to find a good online broker you simply need to look at their systems and decide if they’re easy for you to use.

Some even allow you to open a demo account (with no money) to place fake trades and see how the system really works. And more and more of these online stock brokers are releasing mobile trading platforms… so you can trade from anywhere!

So where do you start?

I start with Barron’s. Seriously. They’re the weekly newspaper published by the Wall Street Journal and they do a great job every year ranking online brokers… (here’s a link to the 2020 online stock broker review). It’s the best source to find online stock brokers. They do a great job testing the systems and you can’t go wrong using one of these online brokers.

Just in case, this is a list of the top 10 online brokers Barron’s lists on their site:

- Fidelity

- Interactive Brokers

- E*Trade

- TD Ameritrade

- Charles Schwab

- TastyWOrks

- Merrill Edge

- Ally Investments

- Sogo Trade

There are others, but this is a good place to start your research.

Penny Stock Online Stock Brokers…

Now a word of warning… not every online stock broker will allow you to trade penny stocks. Many have limits that prohibit trading below $5! I find this ridiculous… but I’ve seen it and experienced it.

So before going through the trouble of signing up and funding your penny stock trading account, make sure the broker will let you trade penny stocks!

Now, here’s one more thing to watch… costs.

Not every broker is the same… some charge more for stock trades… or options trades… or even penny stock trades! Some charge more if you talk to customer service… and some have monthly fees. Some charge you for making too many trades… and others will charge you if you don’t meet minimum trade numbers!

Remember, we’re trading penny stocks to make money – it doesn’t make sense to hand your hard earned profits over to your stock broker!

So make sure you understand the fee structure and all the ins – and outs – of the costs, fees and requirements.

So, what about Foreign Penny Stock Brokers?

This is a great question… Trading penny shares on foreign exchanges can be very difficult. Last time I checked only a handful of brokers could trade on foreign exchanges like the Canadian or London Exchange.

Part of the problem is brokers must be licensed by both exchanges and the additional regulatory agencies adds costs and complexity.

And, when I last checked, the fees for trading international penny stocks on a international exchange was through the roof. Some brokers were starting minimum trade costs at $100 a trade!

They might as well just say “Don’t Trade Here!”

Those of you who think outside the box might think of a creative solution. You might think you can just call an overseas broker and set up an account there – sorry no dice. It’s incredibly difficult for US citizens to own and trade penny stocks

internationally… It’s actually illegal for a regular US citizen to buy stocks overseas (unless thousands of hoops are jumped through).

You can thank your overzealous US Federal government for the restrictions.

Look, at the end of the day, the US has plenty of penny stocks to trade… I don’t see much need to go overseas!

Now, what about trading penny stocks without a broker…

Well some companies have programs called direct investment plans… direct stock purchase plans… or DRIPS (dividend reinvestment plans).

Often times you can use these plans to buy stock directly from the company… sidestepping a broker…

BUT… and this is a big BUT…

You still pay a fee to buy and sell stocks… and often times the process is slow, so don’t expect to trade in and out using these programs.

Finally, these programs are expensive for the company to manage… so you’ll only find them at the largest companies out there – I’ve NEVER seen DRIP programs at any penny stock companies I’ve traded. (And believe me, I’ve looked!)

If you find a small penny stock that has a DRIP program, let me know please!

So, while in theory you might be able to buy penny stocks without a broker… in reality, it’s not going to happen!

Since you’re stuck using a broker, here’s a few things to consider…

Do You Have The Right Penny Stock Broker?

There are two types of traders, in my experience.

The type that needs a brokers help… and the penny stock trader who doesn’t.

If you don’t need a broker’s help, stick with the bigger online trading firms, and you’re golden.

However, if you’re the type of investor who likes to work with a broker… no problem.

But I want to warn you about dirty brokers…

You’ve got to be careful about who you choose to work with. You see a broker will always be trying to sell you things… always. Don’t forget he’s a salesman and his job is to sell. So when he calls you with a hot stock tip, just remember he’s a salesman.

Remember, that’s how he gets paid and puts money on the table for his family.

There’s nothing wrong with it… and many brokers I’ve met are honest and hard working… but they’re all salesmen.

Now, before you start talking to brokers I want you to check him out. You want to see if your broker has any disciplinary problems, it’s easy to do…

Use this link to look up your broker and his firm.

http://www.finra.org/Investors/ToolsCalculators/BrokerCheck/

It’s a tool provided free of charge by FINRA.org.

You’ll remember we mentioned FINRA earlier…. They’re the self-regulating agency that helps monitor Broker/Dealers… and they have a great deal of information on their website… give it a look when you get a chance – this broker check tool is just a start.

You’ll find it amazing what you’ll uncover about your broker…

Type in your broker’s name and firm, and within 1 second you’ll see his “Record.” Now, this isn’t perfect… the system only reports brokers who have problems in the past… Future problems are much more difficult to figure out! 😉

Trust me, it’s worth the 20 minutes of research to look up your broker and his firm.

It’s step 1 to protecting your money! Remember Rule #1 – Nobody Cares For Your Money More Than You!

If you don’t believe there are shady penny stock brokers out there in today’s day and age…

Just read this article from the Wall Street journal: Finra Fines Brokerage $1M Over Penny-Stock Deals

Like I said… be careful!

After you’ve found a firm, picked a broker, signed up and funded your account (it sounds like a lot – but it’s not) it’s time to start trading penny stocks!

Before we get to trading penny stocks, let’s answer a critical question many penny stock traders have…

How Much Money Do I Need To Trade Penny Stocks?

In my best Dr. Evil voice… “One Milllllllion Dollars”

Ha, just kidding.

You don’t need anywhere near a million dollars to start trading penny stocks. Heck, you could start with $100 bucks. (or whatever the minimum account size your broker has set).

Does that mean you should start with only $100… Nope.

Look, first things first… I’ve said this before trading penny stocks can be risky and even the best looking “Slam-Dunk Trades” can go wrong and lose you money.

So, never forget, you can lose everything you invest or trade penny stocks.

Let me say that again – You might lose the money you invest in penny stocks.

And that means you should never ever trade with money you need for household expenses. Don’t invest in penny stocks with the rent or mortgage money… Don’t buy penny stocks with the money you need for food, or to send your kids to school.

And for god sake, don’t put “Everything you have” into a penny stock – no matter how good it looks or what the scam artist selling you that stock is telling you.

If you ignore this warning… YOU run the risk of appearing on your local news with tears in your eyes crying about how you were scammed!

Just don’t do it.

When you start trading penny stocks use fun money… use money that, if you lose it, it won’t ruin your life.

Look, I’ve been doing this for 20 years… and I’ve lost money on penny stocks (and made money too)… it happens to the best of us… it happens to everyone! Even the greatest traders in the world lose money and make bad trades from time to time.

Now, you can start trading with as little as $100 bucks… I’ve seen it before…

But if you really want the opportunity to score a big winner, you’ve got to have a few thousand to invest. That will allow you to spread your money around in a few trades and still get a decent position… and it ensures you have some capital standing by to invest when great opportunities come around!

Always have some dry powder (cash on hand)…

You’ll kick yourself if you don’t.

Really, you can get started trading penny stocks with any amount of money… so get your account set up and funded and let’s get trading!

Rule #3 – Always Have Some Dry Powder…

In penny stock trading there are many sayings… and this is one that’s tossed about a lot!

“Keep your powder dry!”

If I’ve heard it once, I’ve heard it a thousand times…

The official saying is “Trust in god, and keep your powder dry!” and it’s attributed to Oliver Cromwell. Cromwell was titled the Lord Protector of the Commonwealth of England, Scotland and Ireland.

He played a critical role in English government and military campaigns during the 1640s and 1650s.

And it was during his military campaign in Ireland that he uttered his famous saying.

If you’re not up on military history, back in the olden days, military weapons were very crude.

Fighting with muskets, you had to pack your gun with powder, wadding, and a shot. So soldiers kept little bags of gunpowder for loading their guns. If the powder got wet, from rain, sweat, or river water, it wouldn’t ignite… and the soldier couldn’t fight.

Hence the term, keep your powder dry.

Easier said than done in rainy England and Ireland!

Now over the centuries that phrase has changed quite a bit.

The military no longer needs to load their muskets… and carrying individual sacks of powder is a thing of the past.

Since that time, the saying has taken on a new meaning of being ready for action… being prepared.

So in the case of trading penny stocks, having dry powder, is the same as having cash on hand in your account ready to be deployed when the right opportunity presents itself.

If you’re not ready, and you’ve invested all your money… then you run the risk of missing a great opportunity, because you’re not equipped and prepared!

So, when you trade penny stocks, always have some dry powder – because you never know… that next trade might be the one to turn you into a millionaire!

Now that you’ve got dry powder… and you’re ready to trade… before you place your first trade it’s imperative you understand the next penny stock trading rule…

Rule #4 – Know When To Use Limit Orders And Market Orders…

Alright, let’s get into a bit of the technical details around penny stock trading.

Once your brokerage account is set up, you’ll want to learn how to use it. Make sure to study your brokers how – to guide, or watch the demos… or call the support number and have them walk you thought a trade.

You want to be comfortable making a trade BEFORE the time comes to pull the trigger.

So when you place an order, your broker (or the website you’re placing the order with) will ask if you want to make it a market order or a limit order.

This is a critical thing that every experienced trader needs to understand.

WARNING: If you get this wrong at some point it will cost you BIG money… so pay attention.

Two Ways to Place Your Order

There’s two ways you can place an order. First, you can call your broker and give him (or her) the order over the phone. Or you can go online and enter your order electronically.

Unfortunately, I can’t teach you how to actually place an order. Every broker’s platform is slightly different. Give them a call and they’ll be more than happy to walk you through the process the first few times.

Just about all online firms have a tutorial that teaches you what you need to know to place an order.

Market Orders & Limit Orders

Before you place your first order you’re going to need to determine what price you’re willing to pay for the stock. If you put in a market order, you’ll get whatever price is being asked the second your order reaches the market.

Alternatively, you can put in a limit order. Then, you’ll only get filled if the ask price comes down to where you have set your price.

For example, if you set your limit price at $1.95 or better, you’ll only get filled if the ask price drops to $1.95 or below. There are pros and cons to both limit and market orders.

With market orders, you’re basically guaranteed to get your order filled very quickly. You won’t have to wait for the price to move up or down.

The downside is you may end up paying more for the stock than you intended.

With a limit order, you may be able to get a better price. However, you run the risk of not getting your order filled. If the market doesn’t come down to your price, you won’t end up buying the stock.

You’ll have to decide which type of order works best for you.

I know traders who always put in market orders just so they’re guaranteed to get filled (not always the best idea with penny stocks). And I know people who never put in market orders, they only use limit orders.

I would recommend experimenting with both and seeing which works better for your personal situation and temperament.

HOWEVER – It’s different for Penny Stocks.

As a rule I’ll never enter a market order for Penny stocks… or stocks quoted on the OTC and Pink Sheets.

Because market makers play games that will cost you money.

Investing in penny stocks isn’t like investing in larger, more established stocks. Some of the penny stocks we find are traded on the NYSE or NASDAQ. These exchanges are highly regulated and other than slightly larger spreads, trading a penny stock is just like trading a blue chip stock.

It’s different for OTC and Pink Sheets.

NEVER, NEVER, NEVER place a market order. Here’s why:

On the big exchanges the market makers are required to execute your order in a timely manner. That’s not the case with the OTC and Pink Sheets. A less-than-honest market maker can sit on your order while the market moves. Your market order can be filled at a price significantly different from when you placed the order.

It could get expensive really quickly – and you get to pay the tab!

That’s why you should use limit orders for OTC and Pink Sheet securities.

Now, when you place a limit order, don’t get caught up in the excitement of trading. Oftentimes your limit order won’t get filled right away. When that happens, the market maker might start playing games with your order.

He might move the bid/ask spread up so it looks like you’ll never get filled.

He’s hoping you move your limit order up. You’d be surprised how many people do this. They see the price moving up just a little and then they suddenly get scared.

They start thinking that a big price move is starting. They then change their limit order. All you’re doing is handing dollar bills to the market maker.

As soon as you move your limit order up, the market maker will sell you the stock.

Then a few short minutes later the bid/ask spread is back where we started. Just imagine how much money the market maker generates everyday doing this.

But it’s not illegal.

The secret is to place your order and be patient. To get the stock you want at the right price, sometimes you need to be patient . . . and wait. In the past I’ve waited over three days to get the price I wanted on an order… and sure enough, my patience paid off.

That’s how you beat the market makers at their own game!

Now let’s figure out how to find the best penny stocks to trade and invest in…

What To Look For In A Great Penny Stock

You’re ready…

We’re warmed up and standing on the starting line… your finger is ready to push that BUY NOW button on your brokerage account.

But before we start buying everything in sight, it might be a good idea to understand what makes a good penny stock!

It makes sense right. If you know what a good penny stock looks like, you’ll be able to see it again and again… it’s like stalking Deer in the forest. If you know what your prey looks like and the tracks look like… and where it lives, and eats, and sleeps, and drinks… you improve your odds of bagging a buck!

Hunters spend years learning the tendencies of big bucks… and you need to do the same when it comes to trading and investing in penny stocks.

Here’s a handful of “signs” you’ve found that winning Penny Stock:

- A Good Growth Story – Most great penny stocks I’ve seen have great growth stories. The company has a solid business model and has figured out how to sell their product. Maybe they rolled out a new product, or upgraded an older product. Any way you slice it, sales are jumping… and that’s helping the bottom line.

- Money To Make It Happen – The Biggest risk to any small company is cash. The faster a company grows, the more cash they need to expand their sales team… they need to introduce more production… They need to finance inventory… they are growing the number of employees they have. Without cash, none of that happens!

- A Hot Industry – This “Sign” is based on the old saw, “A rising tide lifts all boats”. If a particular industry is in the dog house with investors, it’s going to be very hard for any company to get attention for their stock. And if the industry is hated, just forget about it… On the other hand, when an industry is loved investors open up their pocket books and start buying. The restrictions and limitations on what they invest in eases up and more money finds its way into small stocks. So watch for the hot industries

- Good Trading Volume – This is where most beginning penny stock traders get stuck in the mud. Even if you’ve found the perfect company, you’ve got to have a market that pays attention to it. And that means trading volume. A few hundred shares a day is a lottery ticket. The market will whipsaw and you’ll be shocked at profits one day, and losses the next. The More volume that’s traded… the more stable the stock for longer term trading.

- Good news and press coverage – This is critical for a stock to really start to grow. Think about the average investor… they don’t do a lot of searching. They pick up the latest investment magazine or newspaper and read about a handful of companies – and those are the ones they start researching. To get real traction in the markets, a company needs to have not only a steady stream of good news… but they need mentions in the press too! Articles about the company, about management, about their products are all positive… but watch out for the Pump & Dump scammers (more on those later!)

So there you go…

When you’re looking for a quick trade in a penny stock you want to make sure you’re seeing most – if not all – of these signs you’ve found a great penny stock.

So you’re ready to buy… right?!?

Not so fast… Up next how to find these great penny stocks and how to do your due diligence!

How To FIND The Best Penny Stocks

Start with a blank sheet of paper…

Seriously.

You need to throw out all of your preconceived notions about how to find a great penny stock.

I don’t care if you’ve been investing in Penny Stocks for years… I don’t care if you already own 100 or 1,000 penny stocks.

For us to find the best penny stocks… we’ve got to start fresh.

It’s like painting. You wouldn’t leave the pictures and a clock hanging on the wall and paint around them? Of course not… you start fresh. You move the furniture, take everything off the walls, patch holes, dust the wall, and use primer…

What we’re going to do is use our sheet of paper to identify what stocks to start looking at… we’re going to develop a list of stocks to do further due diligence on.

So grab your piece of paper and have it sitting on your desk at all times.

When you find an interesting stock, I want you to write the company name and ticker down… then I want you to identify why it’s of interest to you.

I use three categories: Fast Growing, Hot Industry, and Good News.

You can use whatever you want… but those three are good to start with.

So the first thing you’re going to do is as you read the newspaper, flip through magazines, scour websites and read articles you’ll start stumbling across interesting companies… start writing them down.

You might even see someone email you about a penny stock… 9 out of 10 times it’s a pump and dump scam… more on that later… but sometimes it’s an interesting company. Add it to the list, and we’ll analyze it in a bit.

Ok… after you’re done with the reading for the day I want you to pause and think for a moment.

What industries are hot these days… What industries are COLD?

For example as I write this, Oil prices are plummeting… and there’s no floor in sight… so the oil and energy industry is COLD as a Siberian winter right now….

But…

Healthcare is hot… It’s the second best-performing industry group in the market over the last 12 months. Money is flowing into the sector like crazy. So let’s dig a bit deeper here.

- Do a google search on the top penny stocks in your industry…

- Then use a stock screener to see what kinds of companies pop up… One stock screener I like is Finviz.com. It’s free and does a great job finding stocks on the major exchanges.

- Don’t forget the OTCBB website and pink sheet markets too.

The idea is to identify good penny stocks that are poised to benefit from the interest in the industry. Find a hot industry… find a hot penny stock.

Finally, I do specialty searches in very specific sectors based on things I’m interested in. One week I might be looking at railroads… Another month I’ll look at dividend paying penny stocks (yes, they’re out there!)… and another month I’ll be looking at software companies… I follow my whims and passions.

So, start adding companies to the list and keep this list running.

You’ll start noticing things… you’ll start developing lists of penny stocks that fit into categories and segments… they might be lists of penny stocks on the NYSE, or the Nasdaq, or Penny stocks at their 52-week high. You’ll have penny stock lists coming out of your ears!

After a few weeks you’ll have more investment ideas than you can shake a stick at!

Now I know what you’re thinking – Once You find a hot stock shouldn’t you run out and buy it right away?

NOPE.

If you read an article, an email, or a friend tells you about a penny stock and says “Act fast”… that’s a classic ploy of a scam artist!

Go back and look at all the big winners I pointed out to you…

Notice that they didn’t rocket higher overnight? They moved higher… and higher… and higher… They took weeks and months and yes, sometimes years, to record their record setting gains.

So, once you’ve started your list, don’t be in a rush. Gather your list and when you get 30 to 50 different penny stocks listed, it’s time to move onto the next step…

It’s time to start our research!

Tip # 5 – Always Do Your Own Research

This brings us to Tip number five… Always do your own research.

Let me say this again….

ALWAYS Do your own research.

I don’t care how you found the company… who else is invested in it… what the company claims to do… Always do your own research.

Look, you’ll be tempted… I know I’ve been there.

I’ve made the mistake of having friends tell me about great penny stocks…. I used to rush out and buy them, thinking it was a sure thing.

The only sure bet was me losing money.

Don’t make the same mistakes I did.

I always kicked myself for not digging deeper before buying shares.

Here’s why… you’ll know things others won’t. You’ll see things other people miss. Remember you’re reading about the markets every day. You’re studying the charts and looking for trends – both hot and cold.

You’ll have a unique set of experiences that will influence your investments… and you need to use these skills to avoid the losers.

So, regardless of where you get the idea for a penny stock trade… make sure you do the basics. Do your due diligence and really pay attention to what you’re looking at.

Do your due diligence and you’ll start seeing things other people miss. And this will help you side step losing penny stock trades – and score big when you find a winner!

Now you know exactly what to do when buying your first penny stock. Remember, develop a strategy, find a good honest broker, do your due diligence, and never rush into a trade!